Introduction

In this Proof of Research article, we analyzed the recent Stacks growth and conducted a deep-dive into four unique solutions in which Stacks can continue its strong growth of user and developer adoption.

Since Stacks mainnet launch in January 2021, Stacks has experienced constant growth, reaching more than 70 entities in the ecosystem. Multiple initiatives, including Clarity Universe, Stacks Accelerator, and the BTC Startup DAO, have been and remain crucial in accelerating the network’s growth by training new developers and nurturing new innovators.

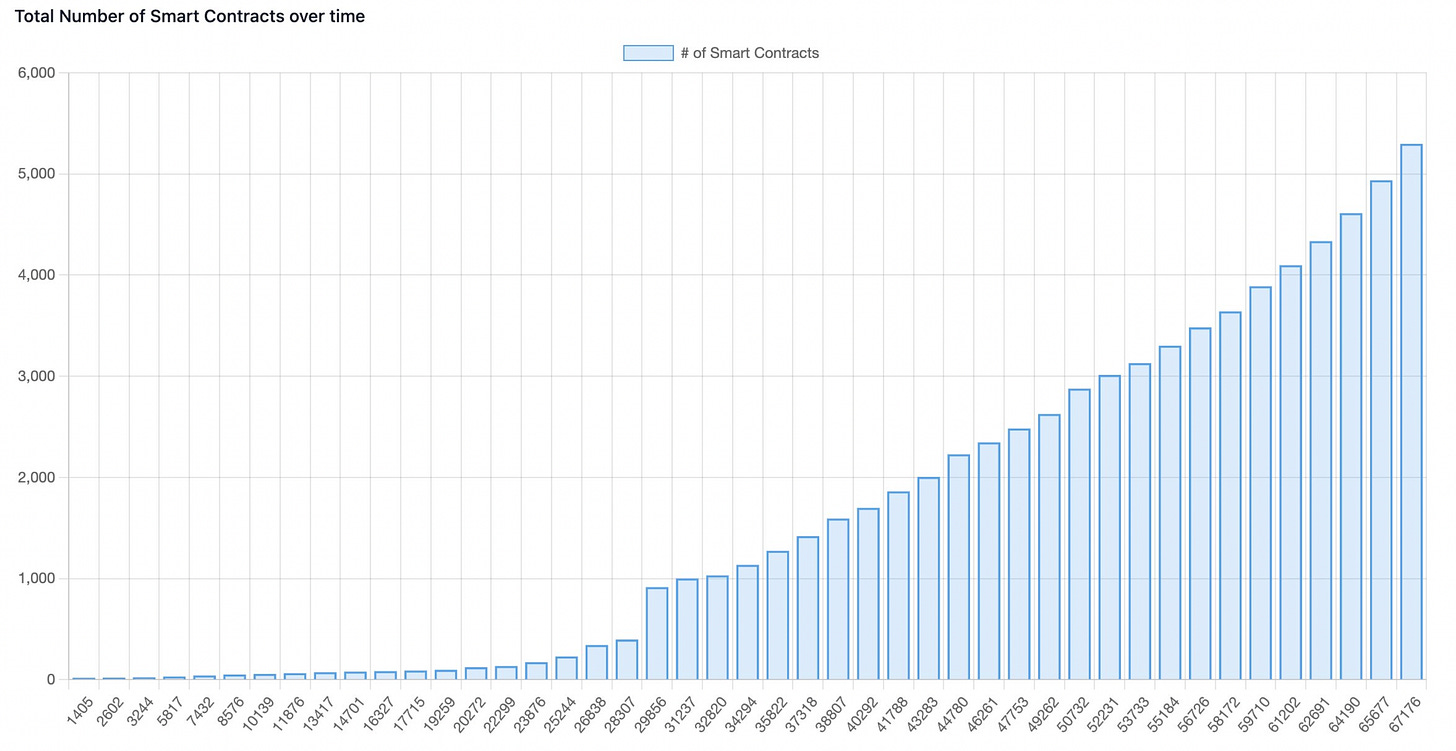

2022 Q2 On-chain data confirm Stacks impressive growth:

STX Addresses increased by 6.5% QoQ

Smart Contracts increased by 58% QoQ

TVL 478M STX to 524M QoQ

BTC Rewards 1127 BTC to 1770 BTC QoQ

While the above statistics prove the Stacks ecosystem is maturing, is it growing quickly enough to catch up with other rival L1 smart contract ecosystems?

The 2021 Electric Capital report1 indicates that the total number of developers since Stacks' launch has not matched the developer growth versus the pace of emerging chains like Polygon, Binance Smart Chain, & Avalanche.

Given that Stacks launched a little more than one year ago, the report’s findings are not particularly concerning. However, if developer traction and core infrastructure for developers continue to lag, this will be cause for concern.

Stacks has unique advantages in that once native BTC capital becomes productive through DLC smart contracts, it unlocks enormous opportunities for developers in the web3 space. Bitcoin capital is approximately $1 trillion, and once Stacks enables Bitfi applications, there will be too many revenue opportunities to avoid building the Bitcoin economy.

Bitcoin is the largest ecosystem by total market capitalization; it has the largest brand name in the crypto industry and first mover advantage. With a couple of technical developments and a strong marketing push, Stacks could see tremendous growth in terms of new monthly active developers.

Nevertheless, the question remains. How can the Stacks blockchain continue attracting developers, users, and investors?

Four core initiatives must be satisfied to ensure exponential growth:

Expand beyond the web3 space

Training & Understanding Clarity language

The multi-chain thesis

Attracting Bitcoiners, many of whom are distrusting of tokens

Stacks Ventures Managing Partner, Trevor Owens recently highlighted some of the most crucial aspects of Stacks’ growth. A few of the key unlocks will be featured later in the article.

Tap into the non-web3 user’s space

Crypto Twitter loves to argue which blockchain will dominate the industry based on technical superiority. The truth is that the average consumer only cares about the experience, not the technical aspects of the blockchain.

User experience is why centralized chains like Solana have achieved tremendous success. The main focus of the chain is to provide a superior user experience. The team behind Solana understands human nature better than any other. Instead of focusing on decentralization, arguably the core characteristic of the crypto industry, Solana instead focuses on speed and dirt cheap gas fees. Solana’s impressive user adoption rate provides hard evidence that the team’s thesis is correct. As a result, Solana acts more like a Web2.0 tech platform than an L1 blockchain.

Stacks is currently testing its own scaling solution, Hyperchains. Hyperchains prioritize the user experience in the same vein as Solana. Depending on the goals of the hyperchain, there will be varying degrees of decentralization and speed. The driving force behind Hyperchains is to provide an elite user experience for the huge number of users that don’t care about decentralization. The architects behind the Hyperchain initiative understand that in order to build the top crypto economy, Stacks will need both true believers and casual normies. Hyperchains will act as L3 solutions with final settlement on Stacks (L2) and final settlement on Bitcoin (L1). Hyperchains can give up elements of decentralization in exchange for Solana-like speed because all transactions will eventually settle on Bitcoin, the ultimate settlement layer in all of crypto.

For this reason, the winning chain will be the one that can offer the optimal user experience. Smart blockchain ecosystems will combine Web3 dApps with the best part of Web2 products and services. Web3 startup accelerators and pre-accelerators (like the Stacks Startup Lab and Stacks Ventures), which understand this concept, are absolutely critical infrastructure if a blockchain has any ambition of climbing into the top blockchain rankings.

Instead of aiming to attract only web3 users or Bitcoin maximalists, Stacks builders should focus on potential users that have yet to join the crypto space. Creating normie-friendly easy-to-use dapps will bring a lot more users and liquidity.

The recent NFT craze is an excellent example as it onboarded millions of new participants into the crypto ecosystem. Many of these new users knew nothing of crypto, Bitcoin, Web3, or cypher-punk culture. NFTs became so popular that celebrities spent millions of dollars to flex their newly acquired PFP’s publicly.

Another example, gaming, is a vast sector and arguably the holy grail for user adoption (i.e. Ready Player One). If the Stacks ecosystem can produce games that are fun and make the user interaction with the blockchain invisible, it would likely help onboard the next million new users.

Clarity Training

Another critical aspect is boosting the small number of Clarity developers in the space.

Many developers choose to learn Solidity as there are plenty of free resources to consult. Instead, Stacks is in the phase of creating libraries, docs, training camps, and other Clarity features. As these are in the early stages, there is a strong need to dominate the SEO rankings on YouTube, Google search, and other online repositories to win over the undecided or curious developer.

For this reason, there is a need to improve the developer documentation and libraries available. In particular, the foundation could create online courses on platforms like Udemy and CodeAcademy in addition to Web3 services like LearnWeb32. This raises awareness of

Clarity language and new developers have an easier time contributing to Stacks.

Another initiative on which the ecosystem should double down is the Clarity Universe program. Clarity Universe is a six-week camp designed to help all developer levels achieve working proficiency with Clarity. The program recently opened for a new cohort of 200 members. If the program can fill it out, this will likely be a good litmus test of developer interest in building on Stacks.

Last week Pointer, a platform that pays you in crypto to learn Web3 development skills, launched a Stacks tutorial and a month-long hackathon that will reward the top five projects with $20,000 worth of STX.

There are alternative ways to onboard new developers. For example, the Stacks Foundation or Stacks Startup Lab could reach out to university blockchain student associations and organize Bootcamps or hackathons with the intent to fund the best ideas.

Another potential solution would be targeting Algorand developers as they also use Clarity as a smart contract programming language. According to the 2021 Electric Capital report, Algorand has been one of the fastest-growing chains in terms of developer adoption.

If you are interested in learning Clarity, you can find helpful information, resources, and documentation on Clarity Universe: https://clarity-lang.org/universe.

The Pointer tutorial is also an excellent opportunity to start learning and working with Clarity:

Cross-Chain Expansion

Stacks could focus on collaborating with other chains as a way to execute the multi-chain thesis.

A recent example is Byzantion NFT marketplace’s decision to become a cross-chain platform by covering NEAR Protocol. Interesting collaborations will likely be developed between the two ecosystems.

In May 2022, it was announced that Orbit bridge was integrating with Stacks. Orbit will enable Stacks users to bridge assets back and forth to Ethereum, Polygon, Avalanche, and other chains.

The Orbit bridge allows the movement of fungible tokens between blockchains, complementing the Satoshible bridge, which enabled the movement of NFTs between Stacks and Ethereum. These bridges will unlock new use cases, particularly in DeFi, such as pairing tokens on Stacks like ALEX and DIKO with tokens from other chains.

To facilitate the onboarding of Ethereum projects, Stacks Hyperchains is looking into the feasibility of an EVM-compatible Hyperchain. Creating an EVM-compatible Hyperchain would make the migration of Ethereum smart contracts to Stacks materially easier as developers wouldn’t need to rewrite their code from scratch.

Attract Bitcoiners

The other aspect of the multi-chain experience is the focus on reinforcing the link and bridge between Stacks and Bitcoin.

Most people in the crypto space own some BTC, and given the unique features of Stacks aimed at unlocking native BTC potential, it could attract many new users but even more, capital put to productive use.

Most dApps on Stacks don’t integrate native BTC enough and therefore don’t give enough incentives for bitcoiners to join the ecosystem. There is a need to be able to purchase NFTs with native BTC as well as to earn a yield on DeFi dApps.

Projects like LNSwap3 and Magic Protoco4l are a great start as they enable swapping BTC to xBTC, STX, and other tokens. Moreover, DLC.Link will allow Stacks to write on Bitcoin, trigger BTC transactions & accelerate the transition of STX as a gas token. As the core infrastructure for native BTC integration is getting built, we should expect new applications and use-cases.

As mentioned in Trevor’s tweet, a significant boost would be the ability to interact with the Stacks ecosystem with any Bitcoin wallet. Many already own a Bitcoin wallet, which would improve the onboarding process. It might seem trivial, but it would unlock all BTC capital in wallets to be used in DeFi and NFTs.

Additional Benefits

Other items that can accelerate Stacks growth are:

Chainlink availability to developers as it’s the most known and used oracle platform.

THORCHAIN5 integrating Stacks in its cross-chain liquidity network; will increase liquidity for Stacks tokens and enable the community to swap STX for native tokens of other chains.

USDC and USDT integration, as the most used stablecoins in the crypto space, will increase the sustainability of Stacks stablecoin like USDA through stable swap pools like BitFLow.

In conclusion, Stacks has consistently grown since its launch in January 2021. According to the 2021 Electric Capital report, Stacks has the most significant number of developers in the entire Bitcoin smart contract ecosystem. Moreover, according to DappRadar, in the last 30 days, ALEX has twice the number of Sovryn’s users, proving Stacks is emerging as a smart contract platform for BTC.

Nevertheless, significant steps need to be taken by the ecosystem to grow and become a leading chain.