DLC.link

Proof of Research ("PoR") is your go-to resource for everything Web3. We provide cutting edge crypto and financial analysis so you can thrive in the wild world of Web3!

Introduction

For our inaugural Stacks dApp review, PoR examined DLC.link. PoR looked into DLC.link’s market opportunity, the solutions it provides, a high-level technical overview, a couple use cases, and the founding team.

DLC.link: An overview of the DLC.link bridge

DLC.link builds infrastructure that allows smart contract interaction with Bitcoin. The vision of DLC.link is to awaken $1 Trillion+ of native BTC capital for productive use. This is the holy grail for all Bitcoin L2 smart contract platforms. Much of this newfound productivity will likely be executed via Stacks’ DeFi infrastructure such as Arkadiko, ALEX and BitFlow. Today, Stacks can read Bitcoin state through Clarity, but Stacks cannot write on Bitcoin.[1][2] DLC.link, in a breakthrough innovation, created a mechanism for Stacks to both write on Bitcoin and trigger BTC transactions via discreet log contract technology. After the creation of Proof of Transfer, we think this is the second most significant development in terms of utility for the Stacks blockchain. For the first time, Stacks applications can execute native BTC transactions, tapping into Bitcoin’s deep pools of capital. To date, Stacks has only been able to transact via synthetic wrapped BTC. For the Bitcoin purists, wrapped BTC is not BTC due to the custodial risks. This criticism is no longer valid. A mature DLC smart contract network is one of the few outstanding unlocks required for Stacks to become the premier smart contract programming layer on Bitcoin.

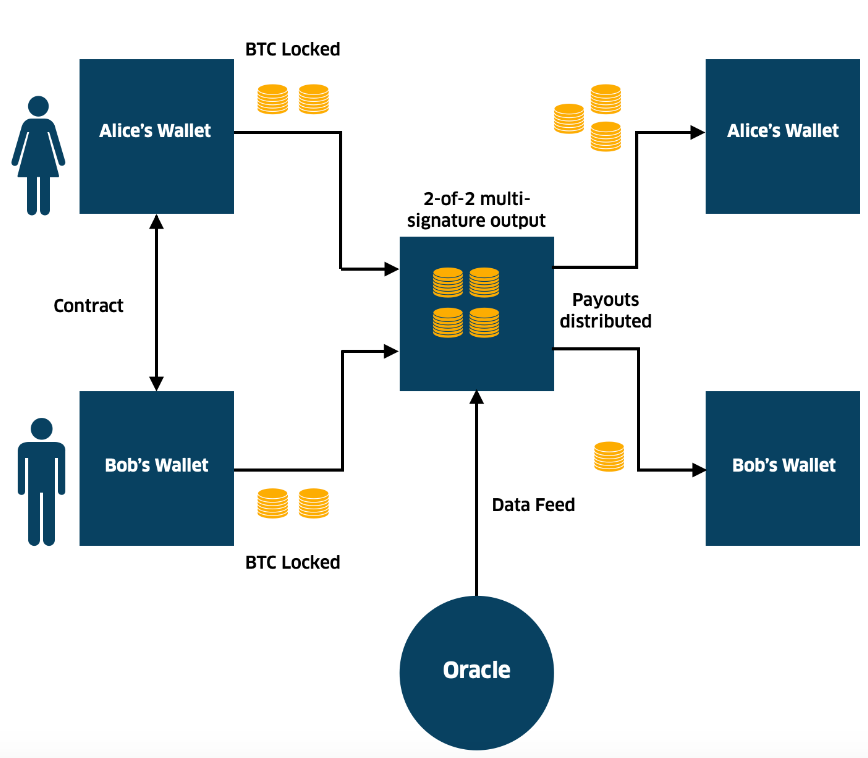

Discreet Log Contracts (“DLCs”) are a type of smart contract that specifically allow for conditional payments using Bitcoin scripting language.[3] A typical DLC transaction involves two or more parties who agree to exchange value (i.e., BTC) dependent upon the outcome of an event, determined by an independent oracle.[4] An oracle is a trusted source of external data that provides tamper-proof inputs that properly settle contracts. Put simply, DLC transactions allow smart contracts written in Clarity to move native BTC without the need to use a custodian. DLCs enables BTC to be self-custodied via a DLC-enabled escrow wallet while leveraging Stacks’ underlying DeFi infrastructure. Effectively, DLC transactions turn STX into a gas token and Stacks dApps into an invisible skeleton of smart contracts for the Bitcoin economy.

Now that we understand the general mechanics of Discreet Log Contract transactions, we need to better understand the DLC contract. A DLC contract on the Bitcoin blockchain looks similar to any other ordinary multisignature output. A multisignature (“multisig”) is a digital signature scheme that allows a group of users to sign a single document, typically in the form of a joint signature.[5] Multisig wallets provide enhanced security for a transaction because all parties involved are required to agree before any transaction occurs. DLC.link transactions provide this form of enhanced security, but for “conditional Bitcoin payments.” Additionally, DLCs behave as secure holding spaces on top of the underlying Bitcoin blockchain. Said another way, a DLC transaction is only known amongst the parties to the transaction. This built-in privacy of the DLC contract is a unique characteristic that is not typically found in transactions on Bitcoin.

Use Cases

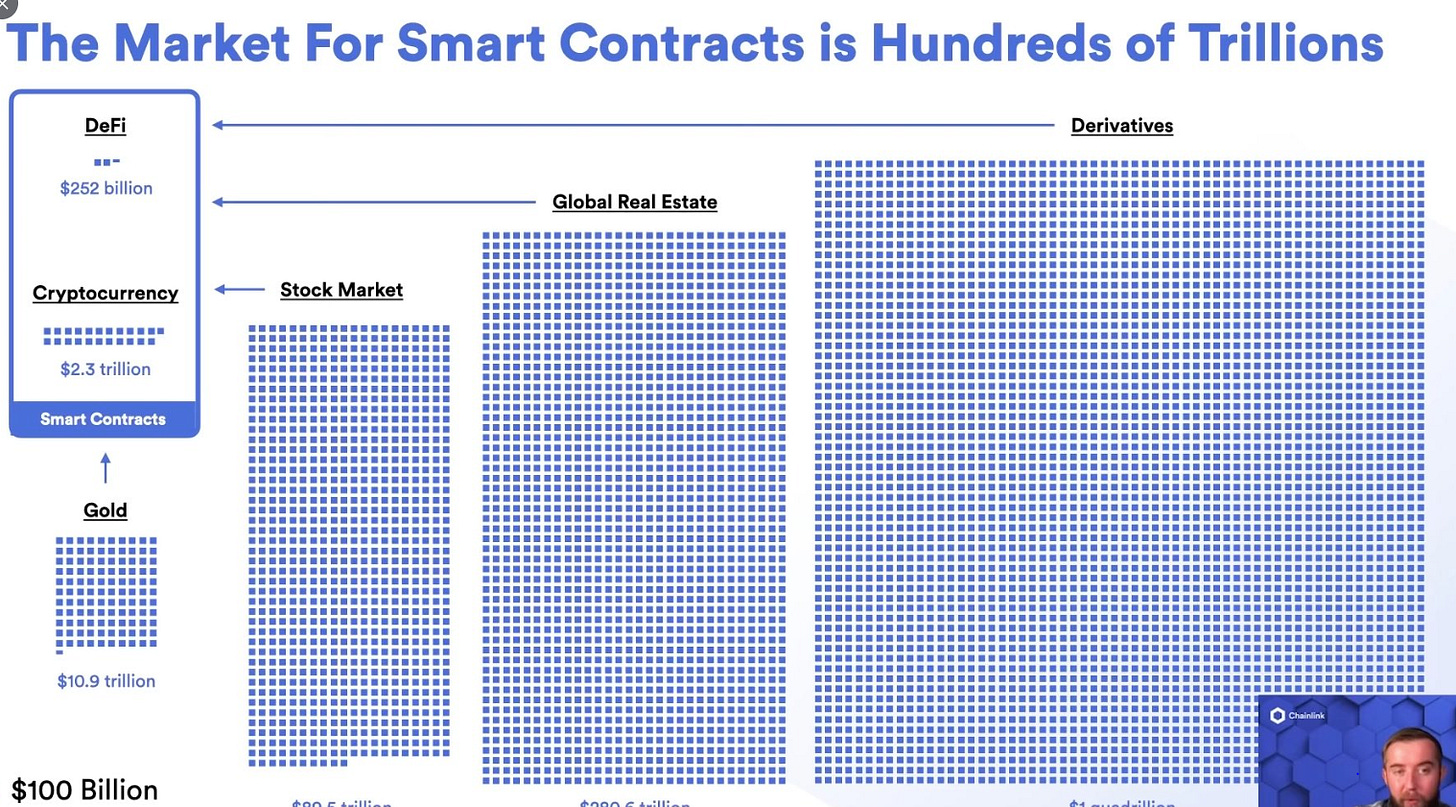

It’s best to understand the mechanics of DLC.link through a couple use cases. Many real-world transactions requiring a trusted 3rd party or escrow account will eventually be replaced by some form of smart contract application. For “conditional payments” on the Bitcoin blockchain, DLC smart contracts will be used to execute this vision. The financial services industry is primed for disruption as many of the industry’s primary transactions involve trusted intermediaries or the use of escrow accounts. This includes traditional financial industries such as borrow/lend, insurance, & derivatives contracts, as well as a host of other services deeply embedded in the financial services industry. Additional crypto use cases include crowdfunding (i.e., a Bitcoin Kickstarter) or receiving payment for completing a survey (i.e., BlockSurvey). The total addressable market for smart contracts is in the hundreds of trillions of dollars in a fully mature crypto economy.

A hypothetical use case is a Bitcoin-backed stablecoin application on the Stacks blockchain. This app is a decentralized, non-custodial liquidity protocol where users collateralize their BTC to borrow stablecoins. Similar to how users mint USDA with Arkadiko or DAI with MakerDAO, a user connects a DLC-enabled wallet to the app’s vault. The user determines the loan parameters which are then sent to the DLC.link oracle system through a smart contract. The user then identifies their Stacks wallet address as the destination for the newly minted stablecoins.

To repay the loan and have the BTC returned, the user can navigate to the app’s vault and send stablecoins to a smart contract that communicates with the DLC.link smart contract. The DLC smart contracts inform the oracle that the debt is repaid. The oracle confirms a “closing event” which either the user or the protocol wallet can obtain to unlock the BTC in the DLC to be returned to the user.

In the event the price of BTC falls below its contractually-agreed upon collateralization ratio threshold, the DLC.link oracle attests to the price of BTC which triggers a DLC “closing event.” The locked BTC is sent back, partly to the user, and partly to the protocol’s BTC wallet in the agreed upon ratios as a result of the liquidating event.

Another innovative use case is a non-custodial STX mining pool. To date, all STX mining pools have been fully custodial. Miners, pool participants that spend BTC to mine STX rewards, lock a specific amount of BTC into their own DLC contract with a BTC lender. The lender loans an amount equal to the total BTC amount locked into the DLC contracts to the Syvita Guild protocol from their own source of BTC funds. Syvita uses the loaned BTC to mine for new STX.

When the BTC is exhausted the mining is complete. The mined STX rewards are transferred to the individual miners who locked their BTC into DLCs with the lender. When the STX rewards are transferred, the DLC.link smart contract should notify the DLC oracle system that the DLC is to be closed. This finalizes the transfer of each committed amount of BTC plus interest as repayment to the lender.

The DLC.link team consists of four key members. Aki Balogh, co-founder and CEO, previously invented the predominant method for SEO content optimization via topic modeling and founded MarketMuse to bring the idea to market.[6] MarketMuse is an AI-driven content intelligence platform that has raised more than $9.2 million to date. Jesse Eisenberg, CTO, has served in a number of software engineering and engineering management roles. This includes stints at Pivotal Labs, MoPub, and Twitter.[7] Dan Von Kohorn, Chief Strategy Officer and Founding Board Member, holds several positions including the head of Enterprise Solutions at Chainlink, advisor to ConsenSys, and Managing Partner at Broom Ventures. Additionally, he is a part-time CEO at IPIQ, an NFT platform to secure intellectual property.[8] Last, Matt Bombard is a Business Analyst. Matt comes from a backgrounds in financial audit and data science at Goldman Sachs and Scotia Bank.[9] Overall, the team is very technically strong and has considerable startup experience.

Conclusion

We are excited about DLC.link’s potential to bring native Bitcoin to Stacks dApps. DLC.link is “incubating” this technology at Stacks with the goal of enabling a new wave of utility for Bitcoiners everywhere. By implementing DLCs, we will take a massive step toward enabling a decentralized financial system of the future.

[1] Management prepared presentation slides.

[2] https://www.stacks.co/learn/features#:~:text=Stacks%20is%20uniquely%20positioned%20to,Bitcoin's%20security%20and%20settlement%20assurances.

[3] https://blog.chain.link/dlc-link-chainlink-grant-bitcoin-discreet-log-contracts/

[4] https://docs.google.com/presentation/d/1nmAws-JRWvXG1hOY-5dh2v8e0Jx9ZIbanDo8hNgxDck/edit#slide=id.g11f9462b662_0_218

[5] https://en.wikipedia.org/wiki/Multisignature

[6] https://www.linkedin.com/in/akibalogh/

[7] https://www.linkedin.com/in/jesses16/